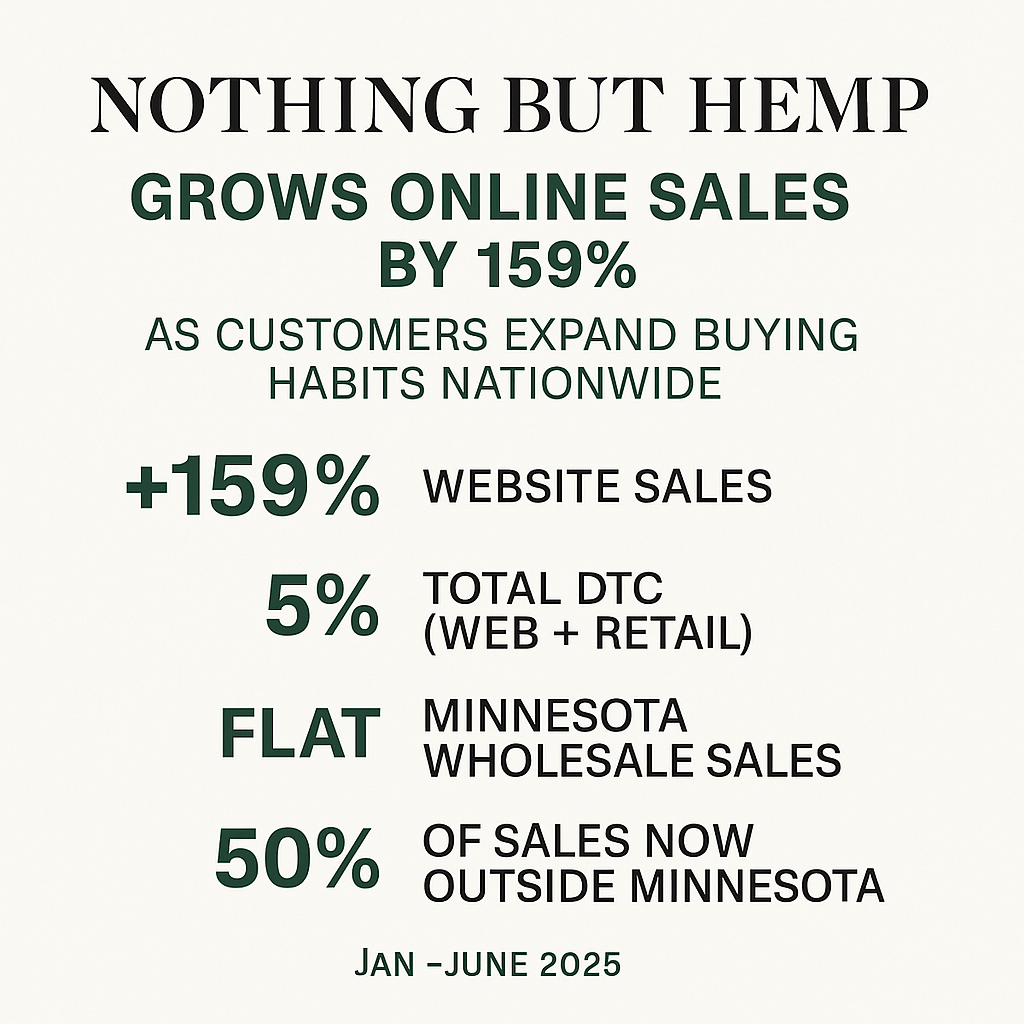

By Nothing But Hemp | June 10, 2025

Minnesota’s 2025 budget has made national headlines with the approval of a significant cannabis tax increase, raising the statewide excise tax from 10% to 15%. While the hike is already drawing concern across the state, the impact will be especially felt in Saint Paul and Minneapolis, where total cannabis-related taxes are set to approach—or even exceed—30%, making them the second highest taxed cannabis markets in the country, just behind some regions in California.

Understanding the Cannabis Tax Stack

Effective immediately, Minnesota cannabis sales are subject to:

-

State Cannabis Excise Tax: 15% (raised from 10%)

-

State General Sales Tax: 6.875%

-

Local Sales Taxes:

-

Saint Paul: 9.875% (includes city and county)

-

Minneapolis: 9.07%

-

Additionally, cities and counties are authorized to impose up to a 3% local cannabis excise tax—on top of existing sales and state excise taxes. If Saint Paul or Minneapolis enacts the full 3%, the combined tax burden on cannabis purchases could exceed 30%.

Example: Potential Total Tax on a $100 Cannabis Purchase

| Location | Sales Tax | Excise Tax | Local Cannabis Excise (potential) | Total Tax |

|---|---|---|---|---|

| Saint Paul | 9.875% | 15% | 3% | 27.875% |

| Minneapolis | 9.07% | 15% | 3% | 27.07% |

| Add’l local tax approval | — | — | ✓ | ~30%+ total possible |

Industry and Consumer Concerns: Legal Market at Risk

Industry experts and advocates are voicing strong concerns over the implications of such high taxation—particularly in a market that hasn’t fully opened to adult-use marijuana yet.

“Piling nearly 30% in taxes on legal cannabis products is a perfect recipe for pushing consumers back to the illicit market,” said Steven Brown of Nothing But Hemp. “We risk pricing out everyday consumers and handicapping small businesses before the real market even begins.”

Many small operators fear being squeezed out of the market entirely. Hemp-derived THC businesses, which have helped normalize legal THC consumption in Minnesota since 2022, now face steeper costs without transitional support or business incentives from the state.

A Legal Market That’s Punitive Before It Begins

Unlike other states that implemented tiered or delayed tax models to help stabilize the legal market, Minnesota’s tax structure is launching at full force—with no phase-in period.

Worse still, the state has not yet issued retail cannabis licenses, meaning the hemp-derived THC sector is bearing the brunt of the tax hike alone—for now.

Second Highest in the Nation

With the combined sales, state excise, and potential local cannabis taxes, Saint Paul and Minneapolis would rank second only to parts of California, where cumulative taxes often hit 35% due to local business taxes and cultivation fees.

Such a heavy-handed approach threatens to undermine the very goals of legalization: replacing the illicit market with a safe, regulated, and accessible system.

Bottom Line:

If implemented as authorized, Minnesotans—especially in the Twin Cities—could face 30% or more in taxes per cannabis purchase, making it one of the most expensive places in the U.S. to buy legal weed. The question now is: Will the market survive it?