Nothing But Hemp Blog

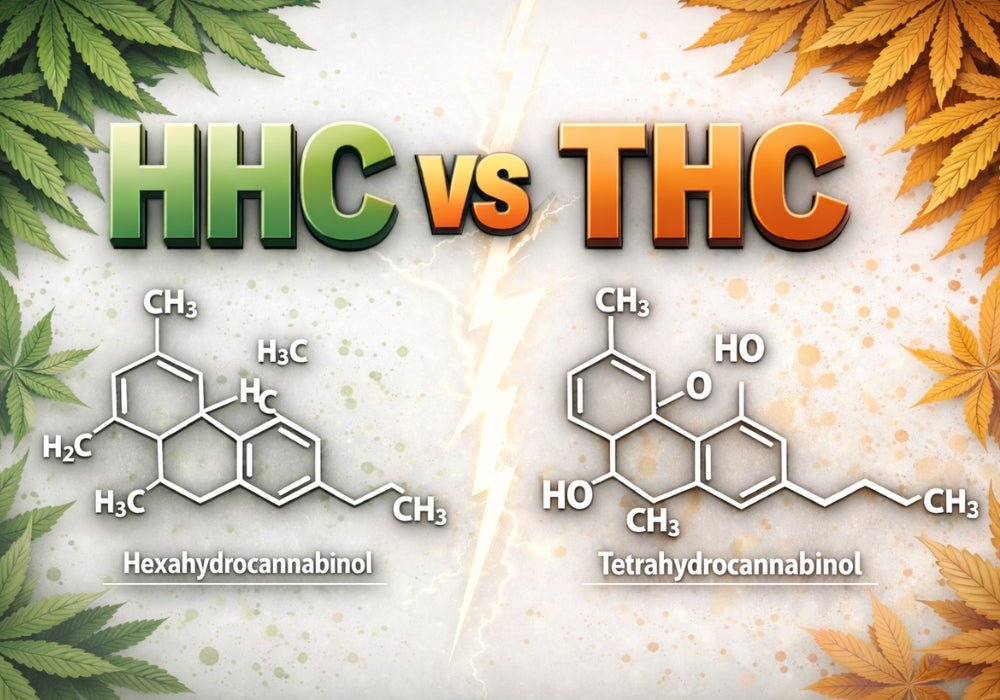

HHC vs THC: Key Differences, Effects, and Legality Explained

THC has been researched for over 50 years through thousands of studies, while HHC only began appearing in consumer products around 2021. Despite this, both are now found side by side in vape menus ...

Ohio’s Carve-Out Problem: How Beverage-Only Lobbying Is Fracturing the Hemp Industry

Ohio didn’t just pass another restrictive cannabis law. It exposed a strategic failure inside the hemp industry that has been building for years.

Governor Mike DeWine recently signed legislation th...

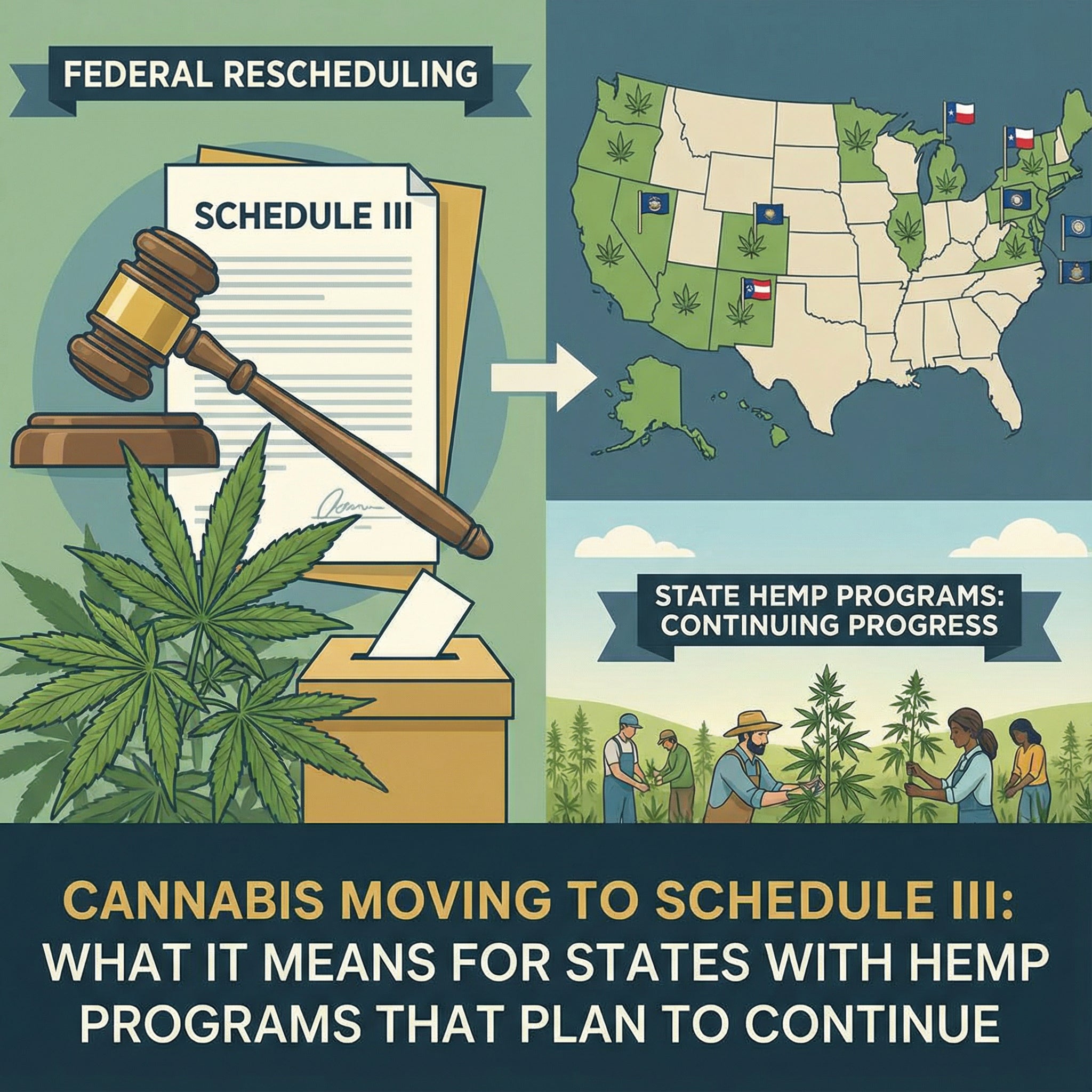

Cannabis Moving to Schedule III: What It Means for States That Plan to Continue Hemp Programs If a Federal Hemp Ban Goes Through

As cannabis moves toward Schedule III at the federal level, much of the public conversation has focused on what this change means for licensed marijuana operators. Less attention has been paid to a...

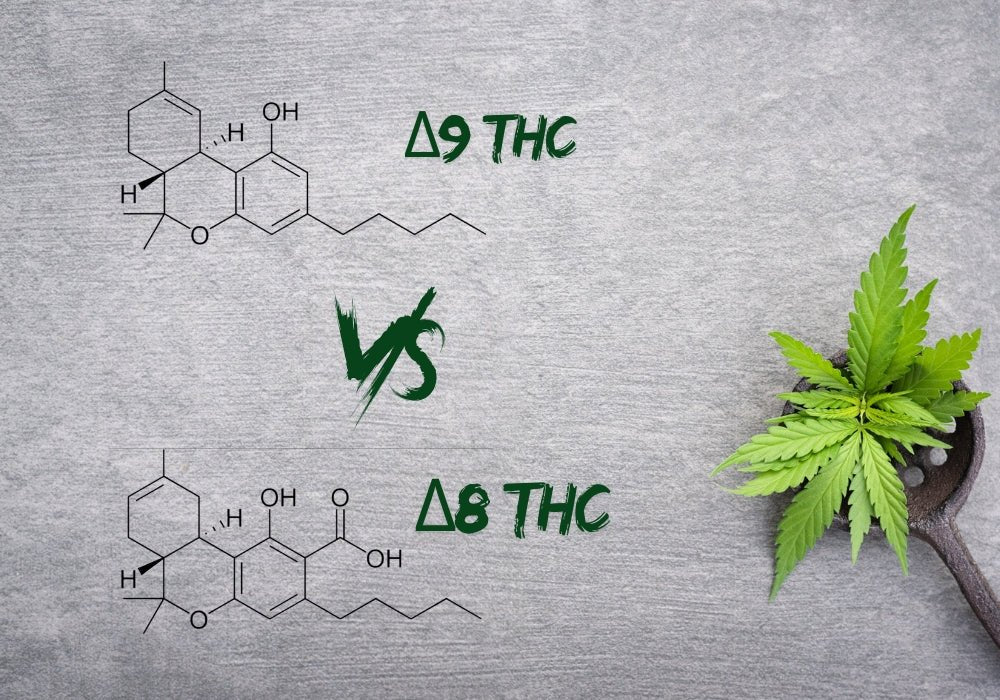

Delta-8 vs Delta-9 THC: Effects, Benefits, and Legal Status

When it comes to delta-8 and delta-9, it’s always a face-off between which is a better legal high. Delta-9 has been notorious for quite a few decades, buxt has now established a solid foothold in t...

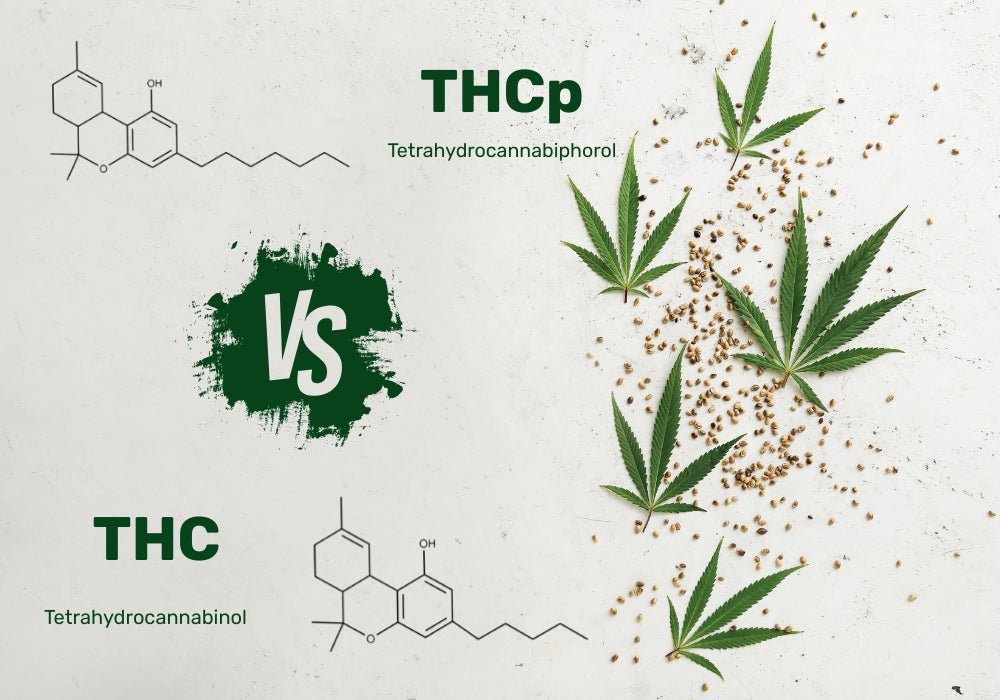

THCP vs THC: What’s the Difference and Which Is Stronger?

In nearly a year, a ban on hemp-derived THC (and its derivatives) is about to take place not just in Minnesota, but in other states, too. As stricter regulations roll in within the hemp market , mo...

Can This Bill Save Hemp? The High-Stakes Battle Behind the Cannabinoid Safety and Regulation Act

A long-form feature on the bill that could rewrite the future of hemp in America

I. The Day the Clouds Shifted Over Hemp Country

On an otherwise ordinary afternoon in Washington, two senators fro...

Minnesota’s January 1 Cannabis Testing Meltdown: A Satire About Two Labs, Thousands of Products, and One Giant “Oops”

Minnesota’s hemp and cannabis industry is preparing for January 1, a magical date when regulators apparently believe the laws of mathematics, physics, and common sense will all link arms and cooper...

“Safety” Has Become a Weapon — And the Hemp Industry Is Its Latest Target

If you work in the hemp industry, you’ve probably noticed a pattern: the second someone wants to push hemp out of a market, limit consumer choice, or hand the industry over to the highest bidder, t...

The OCM’s Great Starvation Diet for Small Cannabis Businesses

The Office of Cannabis Management didn’t just fumble Minnesota’s cannabis rollout — it spiked the ball into the ground, blamed gravity, and then told small businesses, “Well, you chose to play.”

He...